|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

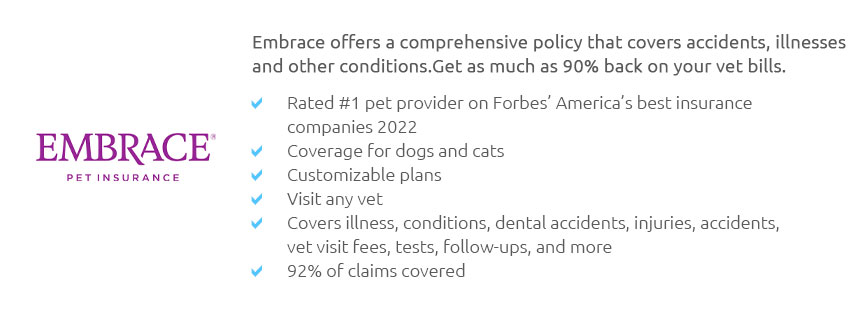

Exploring Pet Insurance Options in Your Area: Expert Tips and AdviceIn recent years, the landscape of pet ownership has evolved significantly, with pet insurance becoming an increasingly popular topic among pet owners who are seeking to ensure the well-being of their furry companions. Navigating the myriad of pet insurance options available in your area can be a daunting task, but understanding the nuances can lead to better decision-making and peace of mind. First and foremost, it is essential to understand what pet insurance typically covers. Most policies are designed to help mitigate the costs associated with unexpected veterinary expenses. This can include surgeries, treatments for illnesses, and sometimes even routine care. However, the coverage can vary widely between providers, making it crucial to carefully examine the details of each policy. When exploring pet insurance options, it is advisable to start by assessing your pet's specific needs. Consider their age, breed, and any pre-existing conditions that might affect coverage. For instance, some breeds are prone to specific health issues, which may influence the type of coverage that is most beneficial. Additionally, the age of your pet can impact premiums and the level of coverage available. Researching Providers Once you have a clear understanding of your pet's needs, the next step is to research insurance providers in your area. A helpful approach is to create a list of potential insurers and delve into customer reviews and ratings. This can provide insight into the company's reputation for customer service and claim processing efficiency. Additionally, speaking with your veterinarian can offer valuable recommendations, as they may have firsthand experience with certain providers and can advise on which companies are most reliable. Comparing Policies With a shortlist of providers in hand, compare the policies they offer. Pay attention to the specifics such as the deductibles, reimbursement levels, and annual limits. Some policies may offer a higher reimbursement rate but come with a higher premium, while others may have lower premiums but a higher deductible. It is important to find a balance that aligns with your budget and provides adequate coverage for your pet's potential healthcare needs. Understanding Exclusions and Limitations Another critical aspect of evaluating pet insurance is understanding the exclusions and limitations of each policy. Some insurers may not cover hereditary conditions or may have waiting periods before coverage begins. These details can significantly impact the usefulness of the policy, particularly if your pet is predisposed to certain health issues. Making an Informed Decision Ultimately, the goal is to make an informed decision that provides the best possible care for your pet without breaking the bank. It is beneficial to periodically review your policy to ensure it still meets your pet's needs, especially as they age or if their health status changes. In conclusion, while the process of selecting pet insurance can seem overwhelming, a methodical approach that involves assessing needs, researching providers, comparing policies, and understanding exclusions can lead to a decision that safeguards your pet's health and your financial well-being. By doing so, you can focus on enjoying the companionship and joy that your pet brings, knowing that you are prepared for whatever the future may hold. https://www.petinsurance.com/

A pet insurance plan lets you give your furriest family members the best health care possible by reimbursing you for eligible veterinary costs. https://www.yelp.com/search?cflt=petinsurance&find_loc=Seattle%2C+WA

On their website: pet insurance. We have used "My Neighborhood Buddy" for pet sitting of our dog and cats on numerous occasions over the last few years with ... https://www.reddit.com/r/Seattle/comments/1cjs8g6/pet_insurance_in_seattle_for_dogs/

10 votes, 53 comments. I just got a 2 year old lab Posting this here since premiums are location based. Is there any pet insurance you ...

|